The increase in exports to the pre-pandemic levels, the notable increase in workers’ remittances and the relative stability in the domestic foreign exchange market supported Sri Lanka’s external sector in February 2021. The trade deficit in February 2021 broadly remained unchanged at the level reported a year ago.

In the financial account, both foreign investment in the government securities market and the Colombo Stock Exchange (CSE) recorded net outflows in February 2021. The SAARC FINANCE swap facility of US dollars 400 million obtained from the Reserve Bank of India in July 2020 was repaid in February 2021 upon maturity. Net inflows to the domestic foreign exchange market eased the pressure on the exchange rate during the month and the regulatory measures enabled the Central Bank to absorb foreign exchange on a net basis, to build up gross official reserves.

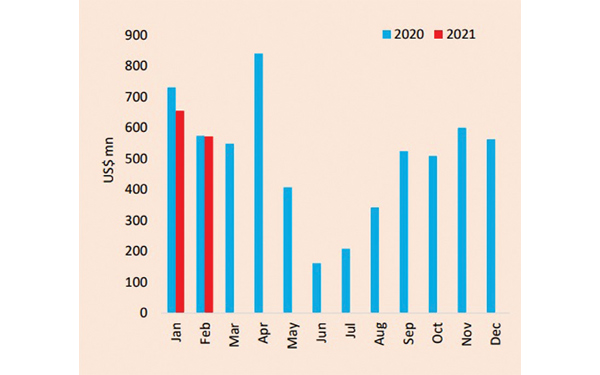

The deficit in the trade account in February 2021 amounted to US dollars 572 million and broadly remained unchanged, compared to the deficit recorded in February 2020. Both exports and imports were slightly lower in February 2021, compared to February 2020. Meanwhile, the cumulative deficit in the trade account during January - February 2021 narrowed to US dollars 1,227 million from US dollars 1,304 million recorded over the same period in 2020.

Export earnings from agricultural goods increased by 5.9 per cent in February 2021, compared to a year ago, mainly contribute by spices, coconut and tea.

Earnings from merchandise exports in February 2021 declined by 3.7 per cent to US dollars 952 million, compared to February 2020. Export earnings exhibited a recovery towards pre-pandemic levels since the peak of the second wave of COVID-19 spread in Sri Lanka, reaching levels close to those recorded in the same month of 2020 (US dollars 989 million) and 2019 (US dollars 981 million).

Earnings from the export of industrial goods declined by 6.3 per cent in February 2021, compared to a year ago, mainly due to the decline in earnings from petroleum product exports by 60.8 per cent (y-o-y) and textiles and garments by 5.3 per cent (y-o-y).

Earnings from the export of petroleum products declined because of the significant reduction in volumes of aviation fuel and bunkering fuel supplied due to lower aircraft and ship arrivals in the country, as well as the reduction in prices for these export products. Earnings from garment exports to the EU increased, while exports to the USA and other destinations declined. Mineral exports in February 2021 were higher than that of February 2020, mainly due to the increase in exportation of items, such as titanium and zirconium ores, slag, graphite, and graphite powder.

Expenditure on merchandise imports was 2.5 per cent lower in February 2021 at US dollars 1,524 million, compared to February 2020.

The increase in expenditure on intermediate goods, and machinery and equipment categorised under investment goods contributed to the pickup in import expenditure. However, restrictions on the importation of certain non-essential goods continued to restrain import expenditure on non-food consumer goods, and transport equipment and building material that is categorised under investment goods.

Expenditure on the importation of consumer goods declined by 16.7 per cent in February 2021, compared to February 2020, with a 3.0 per cent reduction in food and beverages and a 26.4 per cent reduction in non-food consumer goods.

The import expenditure on medical and pharmaceuticals for February 2021 included US dollars 2.63 million incurred on COVID-19 vaccines.

Expenditure on the importation of intermediate goods increased by 3.8 per cent in February 2021, compared to a year ago.

Import expenditure on investment goods declined by 4.7 per cent in February 2021, compared to February 2020. Expenditure on building material and transport equipment recorded a year-on-year decline, while expenditure on importation of machinery and equipment increased, mainly due to increases recorded in relation to computers, transmission apparatus, certain engineering equipment, and industrial and agricultural machinery, among others.

The tourism sector commenced recovering slowly following the reopening of the country’s borders for foreigners. Accordingly, tourist arrivals in February 2021 recorded at 3,366, compared to 1,682 arrivals recorded in January 2021. However, arrivals in February 2021 were 98.4 percent lower than the arrivals of 207,507 recorded in February 2020, immediately prior to the onset of the spread of COVID-19 in Sri Lanka.

Foreign investment in the government securities market recorded a marginal net outflow during the month. A net outflow of foreign investment amounting to US dollars 2 million was recorded in the rupee-denominated government securities market in February 2021, reducing the cumulative net inflow to around US dollars 1 million during the period from January to February 2021. The total outstanding exposure of foreign investment in the rupee-denominated government securities market remained low at US dollars 36 million by the end of February 2021.

There were net outflows of US dollars 26 million from the secondary market of the CSE in February 2021. On a cumulative basis, the CSE recorded a net outflow of US dollars 70 million during the two months ending February 2021.

The level of gross official reserves stood at US dollars 4.6 billion as of the end of February 2021. The Central Bank settled the SAARCFINANCE swap facility of US dollars 400 million in February 2021 upon maturity. Gross official reserves as of the end of February 2021 were equivalent to 3.5 months of imports.

Overall, the rupee recorded a depreciation of 6.8 percent against the US dollar in 2021 up to 16 April 2021.