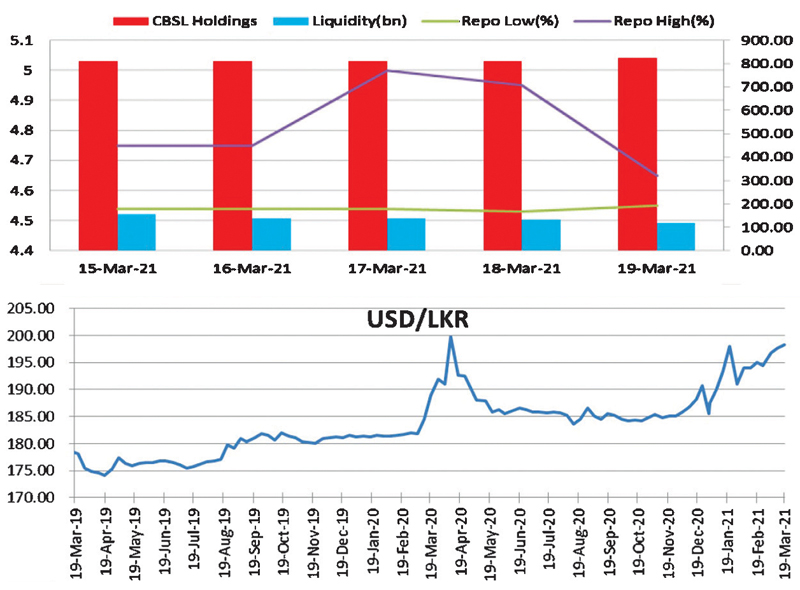

Money Market: Liquidity decreases whilst CBSL holdings increase.

Overnight liquidity recorded a surplus of Rs.119 billion at the end of the week compared to a surplus of Rs.181 billion by the end of last week and overnight Repo was exchanged between 4.50%-5.00% levels in the market. CBSL holding of government securities increased to Rs.824 billion fromRs.810 billion last week. The weekly AWPR for the week ending 19th March 2021 increased by 7bps to 5.61% compared to the previous week.

Government Securities Market Review

Treasury bill Market: Auction under-subscribed for the second consecutive week.

The total accepted amount was Rs.24.8 billion to the offered amount of Rs.45 billion. Weighted average yield of 3M and 6M bills increased by two and one basis points to 5.01% and 5.07% respectively. The benchmark 1-year bill increased by one basis point to 5.11%and bids’ amounting to Rs. 657 million was accepted. Rs. 45 billion worth of treasury bills is to be issued through an auction on 24 March 2021.

Bond Market: Yields see-saw during the week.

The positive momentum witnessed last week subdued during this week as most market participants opted to stay on the sidelines whilst investors took advantage of purchasing bonds from the short spikes noticed during the week.

International Forex Market

The dollar edged lower in early European trading Friday, but remains at elevated levels, supported by higher Treasury yields following the Federal Reserve’s dovish stance. The Dollar Index, which tracks the greenback against a basket of six other currencies, was down at 91.710.

Local Forex Market

Sri Lanka rupee closed weaker at 197.75/198.75 to the US dollar in the one-week market compared to last week’s closing of 197.50/198. The gross official reserves were estimated at US dollars 4,555.7 million as of 28 February 2021.

Commodity Markets

Oil: Oil was up Friday morning in Asia, despite persistent fuel demand concerns and a strengthening dollar remaining as challenges to be overcome. Brent oil futures jumped to $63.80 and WTI futures were up to $60.45.

Gold: Gold was down on Friday morning in Asia, feeling the pressure from climbing U.S. Treasury yields. However, the move upwards to a two-week high during the previous session sets the yellow metal on track for a small weekly gain. Gold futures inched down at $1,731.8.

Economic updates

Sri Lanka suspends the forex surrender requirement.

China to play a central role in supporting ‘CCC’ rated Sri Lanka, Maldives, Laos: Fitch.

Sri Lanka GDP contracts 3.6% in 2020 amid Coronavirus, import substitution.

Stock Market – Review.

At the end of the week, the ASPI has lost 306.09 points to finish at 6,854.32 while the S & P SL20 index which tracks the largest capitalized stocks traded on the CSE has also lost 105.36 points and ended at 2,757.45. The average turnover for the week ending 19.03.2021 was around Rs. 1.1 billion.