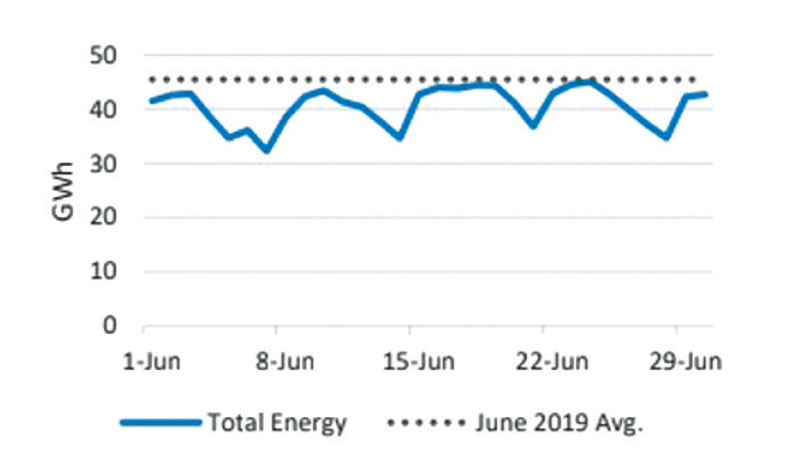

The activities in the economy, especially the industry and services sector, further improved in June as evident by increasing power demand which is almost on par with June 2019 average ICRA Lanka said.

Both the Manufacturing and Services sector showed noteworthy recovery in May. With partial lifting of the lockdown, the economic activities resumed helping the production activities in the manufacturing sector. Employers were seen reinstating some of the jobs they previously cut.

The order books showed improvement. With volumes picking up (especially in food & beverages, and textile & apparel sectors), manufacturers engaged in building input stocks. The supply disruption caused by the COVID pandemic seemed to be fading out slowly.

With improved mobility following the lockdown, trade and transportation sectors saw business activities picking up. Employment in troubled leisure and tourism sectors were seen contracting for yet another month. Backlogs started to deescalate as business is returning to normalcy. The activities in the economy, especially the industry and services sector, further improved in June as evident by increasing power demand which is almost on par with June 2019 averages.

Sri Lanka achieved a trade surplus in June because of the import controls, helped by a modest level of exports (USD 1.02 billion) almost on par with June last year. In the first two weeks of June, excess liquidity gradually started to build up and the CBSL’s SRR cut (200 bps) on 16th caused the outstanding overnight market liquidity to spike to the Rupees 196 billion immediately.

Rupee started appreciating in the first half of the month, which helped the CBSL to accumulate forex reserves. But subsequent to the SRR cut rupee gradually depreciated which was later moderated by the CBSL intervention. Defying the earlier expectations of modest inflation during the aftermath of COVID-19 pandemic, the data indicates the CCPI has declined to 3.9% (Y-o-Y) amidst falling aggregate demand in June, which is now below the lower bound of the CBSL’s inflation target.

The SRR cut and strengthening of rupee triggered a foreign outflow close to R 2 billion in the last two weeks of June. The reserve position improved by USD 193 million in June mainly as a result of increase in foreign currency reserves (USD 427 million) owing to rupee-dollar swap and purchase of dollars from the forex market.

Activities in the real economy are expected to be moderate while inflation to remain benign. Interest rates are likely to remain low. Rupee will broadly remain stable but mild depreciation is likely. Wages may continue to grow at a slower pace. Equities may record modest gains. Commodity prices are expected to maintain the momentum.

Add new comment