Worker remittances grew by 1 per cent, year-on-year, to US$ 626 million in July 2019. On a cumulative basis, worker remittances declined by 8.2 per cent to US$ 3,895 million during the first seven months of 2019 in comparison to the corresponding period of 2018.

Foreign investments in the CSE, including primary and secondary market transactions, recorded a net inflow of US dollars 44 million during the month of July 2019. Accordingly, financial flows to the CSE recorded a net inflow of US dollars 34 million during the first seven months of 2019.

Further, long term loans to the government recorded a net outflow of US dollars 86 million during July 2019. Gross official reserves stood at US$ 8.3 billion by end July 2019, equivalent to 4.9 months of imports.

Meanwhile, total foreign assets, which consist of gross official reserves and foreign assets of the banking sector amounted to US dollars 11 billion as at end July 2019, which was equivalent to 6.5 months of imports.

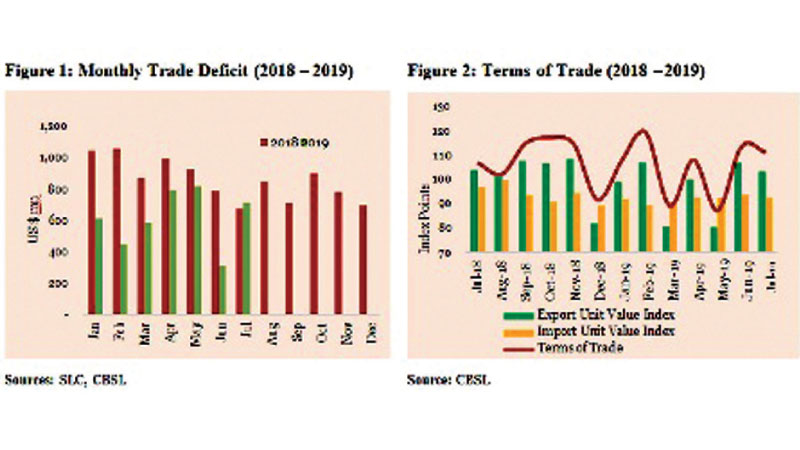

The deficit in the trade account, which contracted significantly since November 2018, widened in July 2019, both on a year-on-year basis and month-on-month basis. In cumulative terms, the deficit in the trade account contracted by US$ 2,076 million to US dollars 4,314 million during the first seven months of 2019 in comparison to the corresponding period of 2018.

Meanwhile, the terms of trade, which represents the relative price of imports in terms of exports, improved by 3.9 per cent (year-on-year) as export prices, on average, reduced at a slower pace than the decline in import prices. However, on a cumulative basis, the terms of trade deteriorated marginally by 0.8 per cent during the first seven months of 2019 in comparison to the corresponding period of 2018.

Earnings from merchandise exports declined by 7.0 per cent (year-on-year) to US dollars 999 million in July 2019 mainly due to a fall in industrial exports followed by agricultural exports.

Earnings from industrial exports declined mainly due to the lower earnings from petroleum products reflecting the impact of lower prices of bunker fuels despite an increase in volumes as well as the base effect of higher direct exports of other petroleum products recorded in July 2018. Export earnings from transport equipment declined considerably by 77 per cent reflecting the base effect of supplying a naval craft to Japan in July 2018.

Rubber products, leather, travel goods and footwear and printing industry products also declined. Meanwhile, export earnings from textiles and garments which recorded a monthly growth of 9.5 per cent on average in the first half of 2019, recorded a moderate growth of 2.1 per cent in July 2019. Earnings from agricultural exports decreased in July 2019 reflected by lower earnings from all subcategories except coconut, rubber and seafood. Earnings from tea exports declined due to the combined effect of low prices and volumes. Earnings from spices declined due to poor performance in cinnamon and pepper.

Export earnings from mineral exports also declined in July 2019 in comparison to July 2018. The export volume index in July 2019 dropped by 6.4 per cent (year-on-year) while the export unit value index also declined by 0.5 per cent, indicating that the subdued performance of exports was driven by the reduction in both volumes and prices, in comparison to July 2018. Foreign investments in government securities recorded a net outflow of US$33 million in July 2019. On a cumulative basis, net outflows from the government securities market amounted to US dollars 129 million during the first seven months of the year. Source Central Bank External Sector

Add new comment