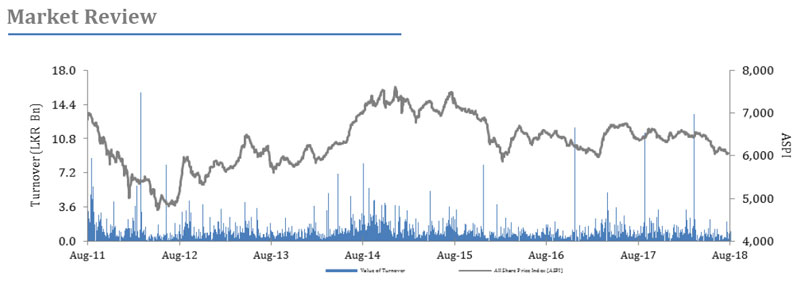

The Bourse turned around to end the week on a negative note as the ASPI decreased by 53.94 points (or -0.93%) to close at 5,761.09 points, while the S&P SL20 Index also decreased by 29.81 points (or -1.01%) to close at 2,916.82 points.

Singer Sri Lanka was the highest contributor to the week’s turnover value, contributing LKR 1.67Bn or 38.30% of total turnover value.

JKH followed suit, accounting for 34.88% of turnover (value of LKR 1.53Bn) while Sampath Bank contributed LKR 0.26Bn to account for 5.98% of the week’s turnover.

Total turnover value amounted to LKR 4.37Bn (cf. last week’s value of LKR 1.56Bn), while daily average turnover value amounted to LKR 0.87 (+180.89% W-o-W) compared to last week’s average of LKR 0.31Bn. Market capitalization meanwhile, decreased by 0.93% W-o-W (or LKR 25.33Bn) to LKR 2,705.39Bn cf. LKR 2,730.72Bn last week.

Liquidity (in value terms)

The Trading sector was the highest contributor to the week’s total turnover value, accounting for 38.33% (or LKR 1.68Bn) of market turnover. Sector turnover was driven primarily by Singer Sri Lanka which accounted for 99.92% of the sector’s total turnover. The Diversified sector meanwhile accounted for 38.32% (or LKR 1.68Bn) of the total turnover value, with turnover driven primarily by JKH & Melstacorp which accounted for 97.48% of the sector turnover. The Banks, Finance & Insurance sector was also amongst the top sectorial contributors, contributing 15.10% (or LKR 0.66Bn) to the market driven by Sampath Bank, Commercial Bank, NDB & Amana Takaful which accounted for 76.27% of the sector turnover.

Liquidity (in volume terms)

The Trading sector dominated the market in terms of share volume, accounting for 37.70% (or 36.15Mn shares) of total volume, with a value contribution of LKR 1.68Bn.

The Banks, Finance & Insurance sector followed suit, adding 19.14% to total turnover volume as 18.35Mn shares were exchanged.

The sector’s volume accounted for LKR 0.66Bn of total market turnover value. The Diversified sector meanwhile, contributed 17.17Mn shares (or 17.91%), amounting to LKR 1.68Bn.

Top gainers and losers

Adam Investment was the week’s highest price gainer; increasing 100.0% W-o-W from LKR0.10 to LKR0.20 while Blue Diamonds [NV] (+50.0% W-o-W), Blue Diamonds (+40.0% W-o-W) and Adam Capital (+25.0% W-o-W) were also amongst the top gainers.

Office Equipment was the week’s highest price loser; declining 19.7% W-o-W to close at LKR68.00 while MTD Walkers (-12.1% W-o-W), Laxapana (-11.8% W-o-W) and Prime Finance (-11.6% W-o-W) were also amongst the top losers over the week.

Foreign investors closed the week in a net selling position with total net outflow amounting to LKR 2.38Bn relative to last week’s total net outflow of LKR 0.49Bn (-387.8% W-o-W).

Total foreign purchases increased by 266.5% W-o-W to LKR 1.17Bn from last week’s value of LKR 0.32Bn, while total foreign sales amounted to LKR 3.55Bn relative to LKR 0.81Bn recorded last week (339.8% W-o-W).

In terms of volume, Dialog & Teejay Lanka led foreign purchases while Singer Sri Lanka & JKH led foreign sales. In terms of value, Cargills & Dialog led foreign purchases while Singer Sri Lanka & JKH led foreign sales.

Point of view

Sri Lankan equities hit a 5-year low on Friday to close at 5761.09 points as it lost ~54 points (0.9% W-o-W) over the week. On Monday, the broad share Index fell below the psychological 5800-mark to 5774.37 and continued to trade below 5800-mark throughout the remainder of the week.

This week’s ~0.9% loss on the ASPI consequently dragged this year’s cumulative loss on Sri Lankan equities down to ~10%. Despite this, activity levels on the market improved during the week, with weekly turnover increasing ~181% W-o-W to Rs.4.4Bn from Rs.1.6Bn last week. On Monday, daily turnover hit an 11-week high of ~Rs.2.0Bn driven by a strategic transaction on Singer Sri Lanka by its current parent Hayleys.

Although Singer was trading below Rs.30.0, Hayleys Group (which already owns >80% of Singer) bought a further 9.47% (35,562,883 shares) at the notably higher price of Rs.47.0 (same as last year’s mandatory offer price). Subsequently, the average daily turnover on the Colombo Bourse increased to Rs.874Mn cf. just Rs.311Mn last week. Local HNI and Institutional investors meanwhile returned strongly to the market this week, with crossings over the week accounting for ~69% of total weekly turnover (cf. just 24% last week).

Large parcels of Singer (~55% of crossings) and JKH (~35%) accounted for the majority of the week’s total crossings. Meanwhile the foreign equity sell-off on Sri Lankan equities continued yet again this week, reflecting both broader global economic developments and continued concerns over the depreciation of the LKR.

The net foreign outflows from the Colombo bourse consequently increased to Rs.2.4Bn (including the Singer transaction of Rs.1.7Bn) cf. just Rs.0.5Bn last week. Although foreign investors recorded a net inflow of Rs.6.1Bn up until February 2018, foreign investors have since sold off Rs.15.4Bn between February to October, bringing the YTD foreign outflow from Sri Lankan equities to Rs.9.3Bn.Markets in the week ahead are likely to take cues from the beginning of the September’18 earnings season.

Manufacturing and service sector growth slows

Sri Lanka’s manufacturing and Services sector activities grew at a slower pace in September, with the leading Purchasing Managers Indicator (PMI) indicating slower growth during the month. Manufacturing Sector PMI fell to 54.1 points in September (cf. 58.2 points in August) amid a slowdown in new orders and production especially in the manufacturing of food and beverage. Despite remaining above the neutral 50-point mark, the PMI shrank to a 5-month low as employment also slowed down. Increased input costs of imported raw materials (due to the 11.6% YTD depreciation of the LKR) meanwhile led to an increase in prices of the manufactured products and resulted in decreased demand for new orders and production.

However, export driven segments such as manufacturing of textiles, wearing apparel and leather experienced an improvement in new orders and production. Sri Lanka’s Service Sector PMI meanwhile fell to 53.0 points in Sep’18 cf. 57.0 in Aug’18, its weakest since the survey began in May’15.

Though the index remained above the 50-point mark, which separates growth from contraction, the slowdown in the service sector was largely driven by slower business activity in accommodation, food & beverage, wholesale & retail trade, health activities and other personal services. The slowdown in import volumes and off-peak season in the Tourism sector also added to the decline in the Index.

Slower business activities also contributed to sluggish employment expansion in Sep’18 while new business growth eased across the financial services and insurance sectors. Meanwhile, Service providers’ outlook on the three months business activities strengthened, albeit at a slower pace, as higher fuel prices along with LKR depreciation and import restrictions impacted survey respondents adversely.

Add new comment