Voahirana Mamy Ravelonoro was working at her small restaurant when a buzz on her phone caught her attention. It was a text message from microfinance bank Baobab Madagascar telling her that she had qualified for an instant, digital loan. “I just went to a Baobab agent, showed them the message and my national identification card, put my finger on the biometric machine, and withdrew the money.”

The extra few hundred dollars came in handy for the Christmas season as Ravelonoro used the cash to buy flour, sugar, and eggs for the restaurant she had recently opened in Madagascar’s capital of Antananarivo. With more stock, she could meet the increased demand over the holiday season—and make a bigger profit.

For years, traditional banks shied away from serving many Africans because of the costs of physical branch expansion and the risks associated with serving low-income people. Small entrepreneurs like Ravelonoro found it particularly hard to access credit as they often lack the required collateral or credit history. But the launch and growth of digital financial services across the continent is changing that situation.

“We’ve understood that digitalization is the right solution for clients,” says Jean Analdo Armand, chief executive officer of Baobab Madagascar. The company’s goal is to be “completely digital” in the near future, and provide credit to even more entrepreneurs and under-banked people.

Since the breakthrough of the first mobile money services in Africa about a decade ago, new technologies and innovative business models such as agent banking (rather than branch-centered banking) have led to the creation of a mass market for affordable, accessible, and sustainable financial services for low-income people, small-scale entrepreneurs, and people in rural areas. This shift has helped lift the financial inclusion rate on the continent from 24 percent in 2011 to 43 percent in 2017.

Pioneers of mobile money and agent banking, like Baobab, have been strengthened by a joint initiative of IFC and the Mastercard Foundation. The Partnership for Financial Inclusion, launched by the two institutions in 2012, had delivered 7.2 million new digital financial services users, 45,000 new banking agents, and $300 million in monthly transactions as of December 2017.

Research by the Partnership for Financial Inclusion has demonstrated that it is 25 percent less costly to expand banking services through an agent network than through traditional bank branches—which should provide incentive for more institutions to follow suit. There is also growing evidence that financial inclusion is a catalyst for equitable development and inclusive economic growth. A Massachusetts Institute of Technology study from 2016 showed that the use of mobile payments service M-PESA in Kenya helped lift 2 percent of Kenyan households out of extreme poverty, and that it was particularly helpful to households headed by women.

A Market for Affordable and Accessible Financial Services

The use of mobile money services generate data that can then be used to automatically assess the creditworthiness of the user, which opens up opportunities for lenders to give credit to people who otherwise lack collateral or a credit history. Greater geographical reach, lower cost, and speed also contribute to the expansion of these services. Sub-Saharan Africa is the only region where more than 10 percent of adults use mobile money. In Kenya and Uganda, over half of the adult population uses digital financial services.

One of the latest projects of the Partnership for Financial Inclusion is a pilot to test the possibility of introducing digital merchant payments in Cote d’Ivoire, in partnership with mobile network operator and mobile money service provider MTN. Its promoters canvass restaurants, hardware stores, and gas stations to demonstrate how to use the simple point-of-sale device and accessories that accept and make digital payments. Should the model prove viable, the ability to pay for goods and services with mobile money may transform even street trade in Africa in the future.

Côte d’Ivoire is well-positioned for this innovation because the country’s mobile penetration rate already exceeds 100 percent (a situation that occurs when people own more than one phone). The nation is also one of the largest mobile money markets in West Africa, with over 12 million registered clients.

The efficiency of mobile money isn’t its only draw. MTN’s service MoMo Pay delivers a solution to a problem unique to Côte d’Ivoire: there is not enough small change in circulation. The situation is so extreme that a secondary market has sprung up in the wake of the shortage: Businesses and individuals sell change to stores that need it, often at a premium of up to 8 percent.

New Opportunities for Micro-entrepreneurs

Besides expanding access to financial services, the growing mobile money industry offers a new career path and additional income opportunities for many small-scale entrepreneurs as mobile banking agents. Agents are local retailers who double as lower-cost alternatives to bank branches, and provide the necessary points for cash-in and cash-out that connects the digital ecosystem with the still-dominant cash economy.

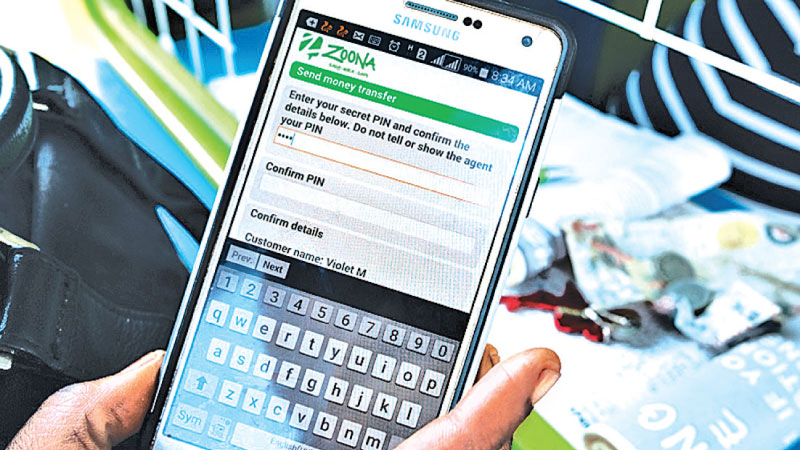

At these establishments, customers can make withdrawals, deposit money, transfer funds, and make payments. For the service, agents receive a fee from customers or commission from the service providers. Some small-scale traders increase their original business revenue by offering additional banking services, while others have become specialized aggregate super-agents with their own agents and employees. In 2016, there were about 1.5 million digital financial services agents in sub-Saharan Africa, working for 140 services in 39 countries and sharing over $400 million in commission income.

One of these agents is Constance Sampa, who in 2012 applied to be an agent for Zoona, a Partnership client institution in Zambia that provides mobile payment services. The 27-year-old bought a booth in Chingola, where she had worked, that became her first outlet. Six years later, she owns 37 outlets and employs close to 50 people, almost all of them women. Her new career has enabled her to go to school and buy a home. “It has helped me so much in my life,” she says.

Zoona is the market leading mobile payments provider in Zambia, and its success is due to its ability to understand the needs of the new customers that have been brought into the financial system via mobile money, according to co-founder and chief customer officer Brett Magrath. “For providers, it may seem like a small thing to get a person to trust you with ten dollars, but for that individual it is a huge amount of money,” he says. “The key to success is to offer digital financial services in an empathetic way and to understand the development needs of the community to drive adoption.”

Add new comment