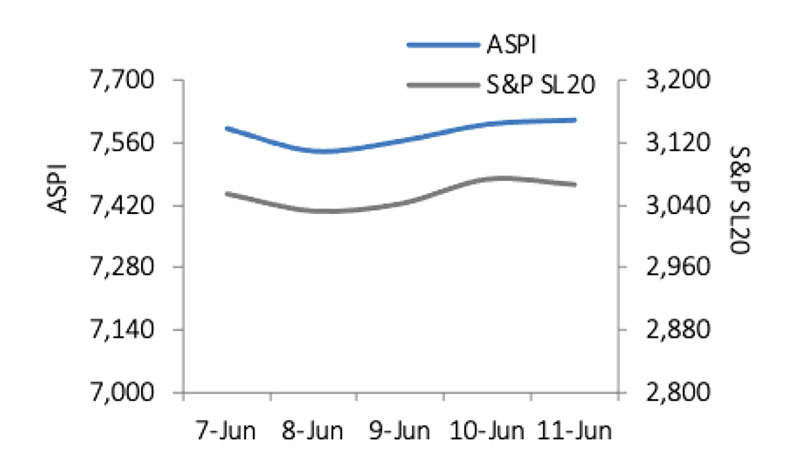

The Bourse ended the week on a positive note this week with ASPI increasing by 42.92 points (or 0.57%) to close at 7,610.30 points, while the S&P SL20 Index also increased by 20.56 points (or 0.67%) to close at 3,067.03 points.

The Bourse ended the week on a positive note this week with ASPI increasing by 42.92 points (or 0.57%) to close at 7,610.30 points, while the S&P SL20 Index also increased by 20.56 points (or 0.67%) to close at 3,067.03 points.

LOLC Holdings was the highest contributor to the week’s turnover value, contributing LKR 0.95Bn or 8.59% of the total turnover value.

HNB (Non-Voting) followed suit, accounting for 7.51% of turnover (value of LKR 0.83Bn) while Prime residencies contributed LKR 0.79Bn to account for 7.13% of the week’s turnover.

Total turnover value amounted to LKR 11.09 Bn (cf. last week’s value of LKR 14.37Bn), while the daily average turnover value amounted to LKR 2.22Bn (-22.85%W-o-W) compared to last week’s average of LKR 2.87Bn. Market capitalization meanwhile, increased by 0.86% W-o-W (or LKR 28.72 Bn) to LKR 3,369.68 Bn cf. LKR 3,340.9 Bn last week.

Dividend Announcements

Company, DPS(Rs.), Dividend Type, Date(XD); LANKA CERAMIC PLC, 0.9, Final dividend, 1/7/2021; C T HOLDINGS PLC, 2.9, Final dividend, 2/7/2021; ALLIANCE FINANCE COMPANY PLC, 5.5, First and Final dividend, 5/7/2021; JANASHAKTHI INSURANCE PLC, 2, Final dividend, 6/7/2021; SINGER FINANCE (LANKA) PLC, 0.8, First interim, 21/06/2021; CEYLON TEA BROKERS PLC, 0.35, Final dividend, 21/06/2021; DISTILLERIES COMPANY OF SRI LANKA PLC, 0.7, Second interim, 22/06/2021.

Key Economic Indicators May; Prime Lending Rate 5.69%, Ave. Wtd. Deposit Rates 4.97%, Ave. Wtd. Fixed Dep. Rates 5.94%, CCPI Inflation Y-o-Y % 4.5%.

Liquidity (Value & Volume)

Capital Goods Industry Group was the highest contributor to the week’s total turnover value, accounting for 21.02% (or LKR 2.33Bn) of market turnover. Industry Group’s turnover was driven primarily by Royal Ceramic, Lanka Walltile and Hemas Holdings which accounted for 48.60% of the sector’s total turnover.

Materials Industry Group meanwhile accounted for 16.91% of the total turnover value while Diversified Financials Industry Group contributed 15.41% to the weekly turnover. The Diversified Financials Industry Group dominated the market in terms of share volume, accounting for 24.33% (or 131.72 Mn shares) of total volume, with a value contribution of LKR 1.71Bn. The Materials Industry Group followed suit, adding 15.37% to total volume (83.20 Mn shares) while Food Beverage & Tobacco Industry Group contributed 13.11% (70.97 Mn shares) to the weekly share volume.

Net Foreign Position

Foreign investors were net sellers this week with a total net outflow amounting to LKR 0.73 Bn relative to last week’s total net outflow of LKR 0.78 Bn (7.4% W-o-W). Total foreign purchases decreased by 10.7% W-o-W to LKR 0.38Bn from last week’s value of LKR 0.43Bn, while total foreign sales amounted to LKR 1.11Bn relative to LKR 1.22Bn recorded last week (-8.6% W-o-W).

Add new comment