The Bourse ended the week on a positive note as the ASPI increased by 127.49 points (or 2.40%) to close at 5,438.91 points, while the S&P SL20 Index also increased by 37.67 points (or 1.62%) to close at 2,359.24 points.

Turnover & Market Capitalization

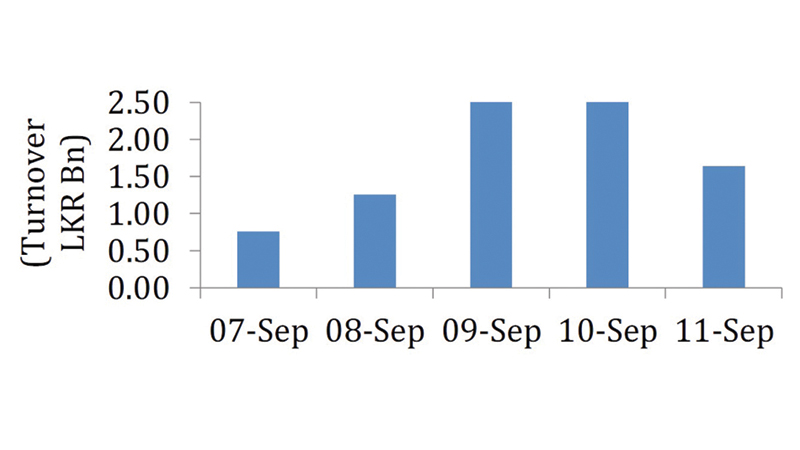

JKH was the highest contributor to the week’s turnover value, contributing LKR 2.92Bn or 30.91% of the total turnover value. Expolanka followed suit, accounting for 4.76% of turnover (value of LKR 0.45Bn) while Sampath contributed LKR 0.39Bn to account for 4.15% of the week’s turnover. Total turnover value amounted to LKR 9.45Bn (cf. last week’s value of LKR 5.30Bn), while daily average turnover value amounted to LKR 1.89Bn (42.75% W-o-W) compared to last week’s average of LKR 1.32Bn. Market capitalization meanwhile, increased by 2.40% W-o-W (or LKR 55.41Mn) to LKR 2,363.82Bn cf. LKR 2,308.41Bn last week.

Liquidity (in Value Terms)

The Capital Goods Industry Group was the highest contributor to the week’s total turnover value, accounting for 42.66% (or LKR 4.03Bn) of market turnover. Industry Group’s turnover was driven primarily by JKH & Access Engineering which accounted for 80.35% of the sector’s total turnover. The Food beverage & Tobacco Industry Group meanwhile accounted for 14.73% (or LKR 1.39Bn) of the total turnover value, with turnover driven primarily by Ceylon Tobacco & Browns Investments which accounted for 28.95% of the sector turnover. The Banks Industry Group was also amongst the top sectorial contributors, contributing 13.27% (or LKR 1.25Bn) to the total turnover, with turnover driven primarily by Sampath, Commercial Bank & HNB accounting for 64.65% of the total turnover.

Liquidity (in Volume Terms)

The Food Beverage & Tobacco Industry Group dominated the market in terms of share volume, accounting for 27.16% (or 140.86Mn shares) of total volume, with a value contribution of LKR 1.39Bn. The Capital Goods Industry Group followed suit, adding 16.69% to total turnover volume as 86.56Mn shares were exchanged. The Industry Group’s volume accounted for LKR 4.03Bn of total market turnover value. The Materials Industry Group meanwhile, contributed 70.13Mn shares (or 13.52%), amounting to LKR 1.02Bn.

Top Gainers & Losers

Blue Diamonds [NV] was the week’s highest price gainer; increasing 50.0% W-o-W from LKR0.20 to LKR0.30 while SMB Leasing [NV] (+50% W-o-W), Blue Diamonds (+40.0% W-o-W) and Unisyst (+29.1% W-o- W) were also amongst the top gainers.

Eden Hotel Lanka was the week’s highest price loser; declining 11.5% W-o-W to close at LKR11.50. Bimputh Finance (-10.9% W-o-W), E B Creasy (-9.1% W-o-W) and Lighthouse Hotel (-7.0% W-o-W) were also amongst the top losers over the week.

Foreign investors closed the week in a net selling position with total net outflow amounting to LKR 1.96Bn relative to last week’s total net outflow of LKR 1.32Bn (-48.9% W-o-W).

Total foreign purchases increased by 8.5% W-o-W to LKR 0.35Bn from last week’s value of LKR 0.32Bn, while total foreign sales amounted to LKR 2.31Bn relative to LKR 1.64Bn recorded last week (41.0% W-o-W). In terms of volume, Lankem Dev. & Renuka Agri led foreign purchases while JKH & Dialog Axiata led foreign sales. In terms of value, Lankem Dev. & Three Acre Farms led foreign purchases while JKH & Ceylon Tobacco led foreign sales.

Dividend Announcements

Company DPS (Rs.) Type XD Date; ASIRI HOSPITAL HOLDINGS PLC 0.800 First Interim 22-09-2020 ASIRI SURGICAL HOSPITAL PLC 0.250 First Interim 22-09-2020.

Key Economic Indicators July: Prime Lending Rate of 7.79%, Ave. Wtd. Deposit Rates 7.16%, Ave. Wtd. Fixed Dep. Rates 8.69%, CCPI Inflation Y-o-Y % (Base 2013) 4.2%.

Point of View

Sri Lankan equities regained its positive momentum this week as the broad share index snapped 2-consecutive weeks of losses amid notable buying interest in select index heavy-weights and blue-chip counters. Consequently, the ASPI rose by ~127 points or 2.4% W-o-W at its close on Friday supported by advances in JKH (+2.3% W-o-W), DIST (+5.8% W-o-W), & SINS (+26.8% W-o-W) which contributed 21% to this week’s total index gain. Heavy buying interest in JKH was also supported by greater local HNI and institutional participation as the blue-chip contributed to the bulk (82%) of this week’s crossings. Consequently, crossings for the week accounted for 28% of total market turnover (cf. 23% last week).

Consequently, activity levels on the Colombo Bourse also improved this week as average daily turnover for the week increased from Rs. 1.3Bn last week to Rs. 1.9Bn this week. Despite the overall positive momentum, the foreign sell-off from domestic equities gathered pace this week led by foreign selling in JKH. Consequently, foreigners were net sellers this week with a net foreign outflow of Rs. 2.0Bn (cf. net outflow of Rs. 1.3Bn last week).

Positive market sentiment was also buoyed by renewed buying interest in the Banking sector amid an amendment to the Banking Act on the ownership of issued capital (with voting rights) for Licensed Commercial Banks (LCBs). The new directive allows any Multilateral Financial Organisations (such as the World Bank, International Finance Corporation, and Asian Development Bank) to acquire a stake of up to 20% in the LCBs as approved by the Monetary Board. However, the stake should be reduced to 15% within 10 years. Furthermore, any other categories of shareholders could also acquire a material interest of up to 15% of the issued capital subject to approval from the Monetary Board. Markets in the week ahead are likely to look for cues from economic and political developments.