The Empower SME Board of the Colombo Stock Exchange is a crucial medium when it comes to helping smaller companies attract investment and also for investors looking to invest in companies that are in their earlier stages.

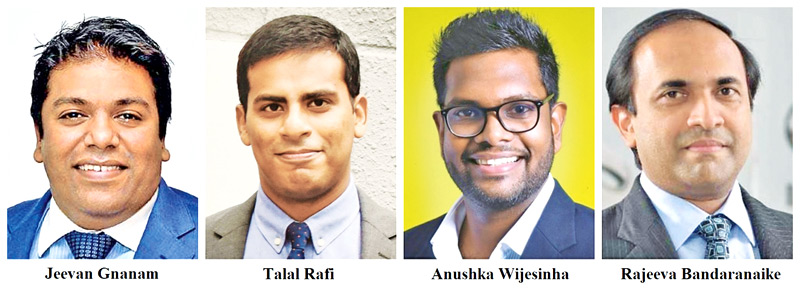

The Colombo Stock Exchange CEO Rajeeva Bandaranaike and industry experts Jeevan Gnanam, Talal Rafi and Anushka Wijesinha shared their views on how the SME Empower Board helps.

Jeevan Gnanam : “An SME board that enables entrepreneurs to IPO at a market cap of even 20-100Mn will be beneficial to facilitate future entrepreneurs. While allowing entrepreneurs market access and liquidity I think it’s main function will be to enable small entrepreneurs to embark on an entrepreneurial journey. Having that experience of listing should enable more risk taking and a more successful generation of entrepreneurs who understand market dynamics going forward.”

Talal Rafi : “The SME Empower Board is a great initiative to help startups looking for investors, especially venture capitalists. Most VCs invest to exit the company at a later stage and having an SME Board can increase the probability of venture capitalists investing in a startup as they know they can exit the company sooner. As the minimum stated capital is Rs 25 million, a VC can invest after getting a pledge from the entrepreneur that they will go public in the SME board soon. This can lead to increased foreign direct investment as well with international VCs investing.”

Anushka Wijesinha : “Access time finance is a perennial issue for our SMEs and the focus has historically been on concessionary loans. From refinanced schemes by donors to interest subsidy schemes, the focus has been on debt. So the SME Board will help change that by adding more opportunity for equity. A lot of new economic opportunities in the country can come from growth-oriented SMEs in diverse sectors, as we transition through upper middle income. So even for investors the SME Board will be a good way to be part of that growth. The prospect of listing and raising capital through the markets will also encourage SMEs to improve how they’re managed and governed. This is good for the whole sector.”

Rajeeva Bandaranaike : “Small and Medium Enterprises (SMEs) are the backbone of the Sri Lankan economy accounting for a majority of enterprises providing half of national employment and contributing to over 50% of the GDP of the country. Innovation in technology, expansion of trade and global value chains are opening up new growth opportunities for SMEs in Sri Lanka.

On their part SMEs are stepping up aiming to be globally competitive, dynamic, innovative and sustainable.

Access to capital therefore becomes a key enabler and SMEs would find that formal credit has its limits and therefore would need to seek complementary and alternative sources of capital raising.

In order to cater to this need, the Colombo Stock Exchange has enabled an opportunity for SMEs in Sri Lanka to access a deep pool of domestic and foreign equity capital through the Empower Board of the CSE. SMEs can, by availing themselves of an opportunity of reaching out to a public market to fund their growth initiatives, reduce their debt burden, tap into a large pool of domestic and foreign investors, enhance their corporate profile ,attract quality talent to the company and obtain optimal value for their enterprises .”

Add new comment