* Middle class of Sri Lanka must understand that they are sitting on a hot volcano.

* Understand the lifestyle changes of a family since 2005

In the recent months various articles have been seen in the newspapers to justify the Chinese loans and its projects and their viability. In the interest of the public it is important to understand the fact of, why countries should get loans and it is per say not a bad thing for a developing nation when it is slow in attracting needed FDI and has problems of raising capital for projects needed for development.

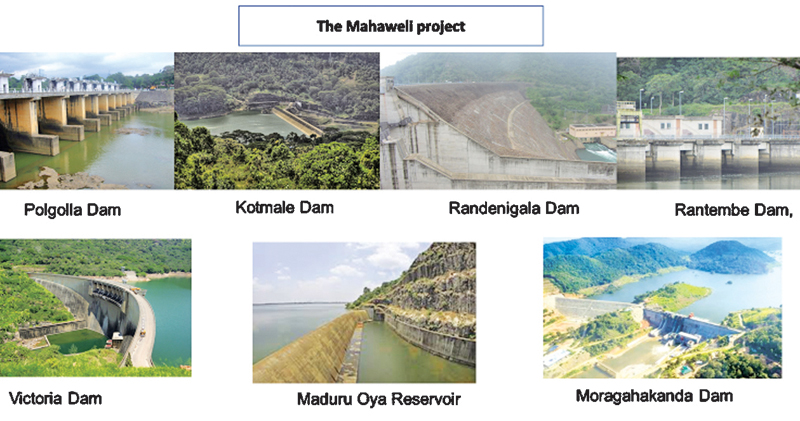

Let’s compare the accelerated Mahaweli multiple projects, mainly funded by European nations and the World Bank (https://en.wikipedia.org/wiki/Mahaweli_Development_programme) vs the Chinese funded recent multiple projects how and if they benefited Sri Lanka and what was the return on investment (ROI) and other criteria?

See Table

Many citizens of the country and mainly the current generation would not know about the Mahaweli project. As shown in the chart the ROI from the Mahaweli project was immediate and for the said projects was immensely beneficial to the country and when each project was completed, the list of benefits to the people are given below. And some of the loans were converted to grants which we never had to pay back, and others were given at very low interest rates and extremely long payment terms (35-40 years) to complete them.

Many citizens of the country and mainly the current generation would not know about the Mahaweli project. As shown in the chart the ROI from the Mahaweli project was immediate and for the said projects was immensely beneficial to the country and when each project was completed, the list of benefits to the people are given below. And some of the loans were converted to grants which we never had to pay back, and others were given at very low interest rates and extremely long payment terms (35-40 years) to complete them.

Immediate benefits of Mahaweli project:

1. Increased the hydro electrification of the country at a very low cost.

2. Provided the needed power to establish economic zones under a new free market and attract FDI.

3. Reduced and eliminated flooding of many cultivated lands and large cities in many parts of the country.

4. New irrigation helped new farmlands for paddy and other crops.

5. Helped develop new cities, schools, hospitals and roads and re settlement in the East and many other parts of Sri Lanka.

6. Created thousands of new jobs in farming and inland fisheries industry.

7. Increased domestic tourism and industrialization.

8. Increased the health of people by providing clean drinking water.

9. New nature reserves and dry zone management.

10. Increased employment through industrialization.

I am sure by now the readers must understand that such loans taken for a massive project which was conceptualized in the sixties with feasibility studies properly done has been well paid off within a very short period to the country and have been a catalyst for economic growth and the standard of living of many millions in rural Sri Lanka. Not only that, the multiplier economic benefits to the country is not visible at a glance and the tax payers’ money have been utilized for extremely productive causes and the project never pushed the country into a debt trap as it generated its own income through the increase in revenue and reduction in cost and creating a chain of new foreign income generation such as increase exports of the country.

This was a classic case of sustainable development in Sri Lanka’s modern history and well utilization of international loans.

Now take the latest wave of infrastructure development in the recent past with Chinese loans.

None of these projects are yielding its own revenue to pay back the loans as at today, they rely on citizens’ other tax revenues to be pumped into these and the ROI projection have been not there, or all hashed up figures. None of them have credible business feasibility done and valuation doesn’t justify the loan amounts taken at very short-term basis for the said projects (5 to 10 years vs 40 years for Mahaweli).

Hambantota port was opened in 2011. Few car carriers started operations in 2013 but never had enough revenue to pay back even the loans of the first stage of the port or the salaries of the workers. The port of Colombo had to pump in money from its revenue to maintain Hambantota, driving Colombo port’s government revenue towards negative returns.

On top of investing USD 350 million loan for the first stage, the then government started the second stage with another $ 800 million loan from china, mind you even at this stage with NO business commitments from the international shipping community.

Even today, after nine years, the Port of Hambantota is not generating revenue to justify the investment. The present government had no option but had to take the Sri Lanka Port’s Authority’s debt burden into the treasury in order to free the SLPA to avoid of collapse of SLPA itself.

They went onto build oil tanks and made a thumping loss of USD 17 million in the first stockpile of refined oil itself.

If one remembers the history, when late Lalith Athulathmudali started the Colombo Port development, he did stage by stage making sure that the institution itself pays for its loans and ensured that the general treasury also gets profits annually to support the country’s revenue through port development. Rajapaksa’s simply together with the Chinese loans turned this method upside down and made the projects a non-viable entity for the Sri Lankan government, made quick commissions and put the tax burden on generations to come.

The Mattala airport is the same, but technically worse. The return on investment on this project cannot be compiled even today. As a result, Sri Lanka will have to go into a strategic joined venture to remove the tax burden on the ordinary people.

The Lotus Tower needs no explanation as the current president himself recently spilled the beans on how and what happened and that the Sri Lankan citizen even without the project being opened must pay Rs. 2.5 billion every year for another ten years from hard earned tax revenue of the country.

Hambantota Cricket Stadium (loans paid by Port authority) International Conference Center, Ranminithanna Tele Cine City are idling for ten years whilst every citizen is paying the loans for infrastructure that even the local business or artist community is not using let alone international businesses.

If China was a friend of Sri Lanka, knowing that Sri Lanka is in trouble they could have given a grant at least on the port. If one may recall the British government, Swedish government and German government even converted some of the Mahaweli loans into grants. Victoria dam is a good example, and mind you that was not at a time where the country could not afford to pay back.

Due to the short-term nature of the Chinese loans we are coming to a stage where many Sri Lankan loans taken during post-independence are now maturing between 2015-2025. It is with greatest difficulty that officials from fiscal and monetary management institutions are delicately balancing the current crisis and stabilizing the destroyed system by the Rajapaksa’s.

This is the secret behind holding presidential elections two years ahead in 2015, hoping to dictatorially and autocratically run the country by crushing the people’s rights and making them slaves of a debt burden created under a disguise of development. Rajapaksa’s very well knew that the international community was not willing to give loans to Sri Lanka anymore to restructure and knew they had to put the burden on the domestic economy making people the victims of the debt payable under an iron fist.

People of Sri Lanka and specially the middle class, must understand that they are sitting on a rotten cake that is decorated by icing, and is on the verge of collapse if the macroeconomy is not managed with patience and prudency. They also must think how the Rajapaksa family has so much of money to live a lifestyle they never had prior to 2005.

Add new comment