With stable interest rates and low inflation, First Capital Holdings PLC Research says that the stability of the economy would further improve during 2018.

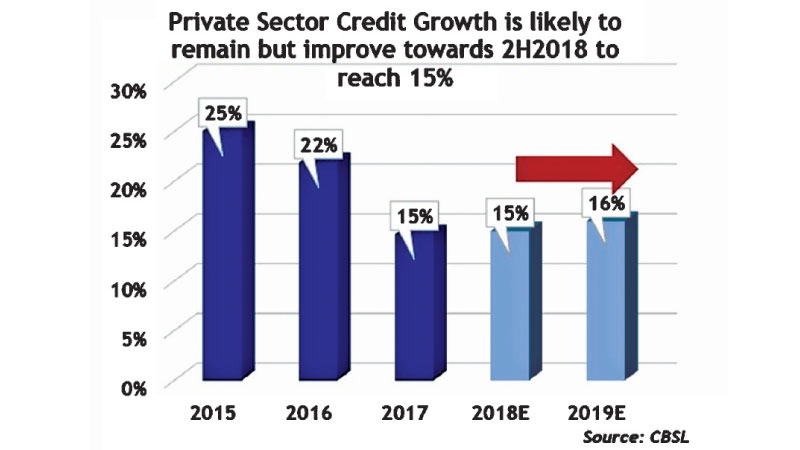

The stable environment is expected to slowly improve business confidence and consumer demand towards 2H2018. “We believe business confidence and consumer demand are currently below average and they are expected to normalize during the period.”

Head of Research, First Capital Dimantha Mathew in their monthly economic review adds that they expect Market returns to be stronger despite slower earnings growth outlook of 5-7%.

“Healthy valuations may warrant a rerating of the market providing returns of 13% market return over the next 6 months while targeting 15% return for 2019E supported by accelerating earnings growth to 10-12%”

Banking rates which has a 6-month lag effect to Government securities are likely experience less volatility over the next 12 months.”

Dollar index is expected to remain strong over the next 12 months while with continued reforms inflows into Sri Lanka debt and equity capital markets are likely with the attractive yields. Further Sri Lanka moves into the peak season of exports Sep-Mar. “We expect more stability in the rupee in 2H2018, but downgrade our target to LKR161.”

We expect the yield curve in Government securities to peak during 3Q in 2018, and register a slow downtrend. Despite having some pressure in 1Q2019 it is not expected to be as high as 3Q2018. Thereby, from bearishness at the start of 2018, we are now bullish on bonds beyond 3Q2018.

“We believe 1Y, 5Y & 10Y trade within the bands of 9.0%-10.0%, 10.0%-11.0% & 10.5%-11.5%. However, it should also be noted that any breakaway from reform program (Deviations affecting IMF program) or political deadlock may result in breaking the upper bands of the tenors.”

First Capital Research expected the yield curve to be upward trending 1Q-3Q2018 with acceleration in the uptrend towards 3Q amidst bunching of debt maturities during 3Q2018.

Following the USD 2.5Bn sovereign bond some stability was seen during Apr 2018. However, business confidence dropped to a 70-month low in Apr 2018.

Contrary to the prevailing uptrend in yields, compared to other tenors, the shorter tenors registered a continuous dip in yields with investors expecting a further rise in the overall yield curve.

Stronger macro fundamentals, higher investments and pickup in consumer demand is likely to increase growth in 2019 end to 5.0%.

Add new comment