The new Inland Revenue Act which took effect will build on international best practices, rationalize the existing income tax structure and help broaden the income tax base by removing exemptions, Moody’s Investors Service said in a statement.

With a very large debt burden and weak debt affordability weighing on its credit profile, successful implementation of revenue reforms will help foster fiscal consolidation. Sri Lanka is currently in an International Monetary Fund (IMF) program in which reforms that contribute to fiscal consolidation are central to meeting IMF program targets.

The government expects the removal of tax exemptions and the introduction of new taxes, including a capital gains tax, to increase government revenue by 0.5% of GDP in 2019 following its first full year of implementation. Moody’s considers this target to be achievable. In addition, tax revenue will be strengthened by improved administration through the rollout of Sri Lanka’s new technology systems and value-added tax compliance strategies.

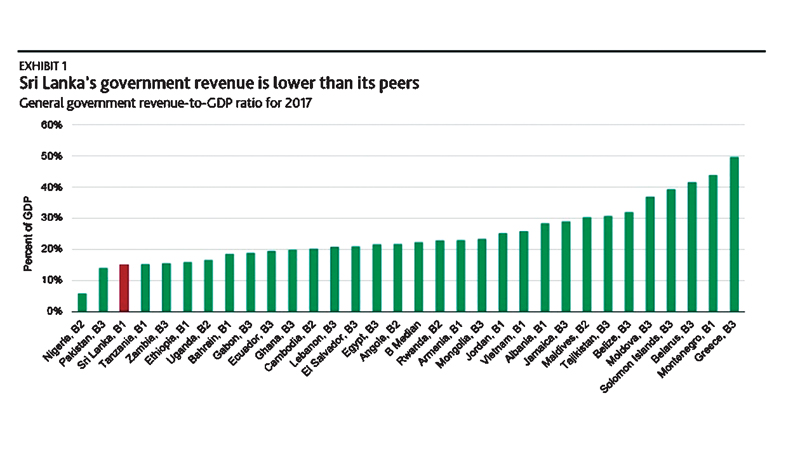

Moody’s expects that these measures will strengthen Sri Lanka’s fiscal metrics, which are weak compared with many similarly rated sovereigns. In particular, Sri Lanka’s government revenue as a share of GDP is lower than many peers, while the government debt-to-GDP ratio is much higher, weighing on its sovereign credit profile.

“We expect government revenue to rise 0.4 percentage point to 15.2% of GDP in 2018 and increase a further 0.8 percentage point to 16% of GDP in 2019. Meanwhile, we expect government expenditures to remain flat at 20% of GDP.

As a result, we forecast the fiscal deficit to narrow to 4.8% of GDP this year and shrink to 4.0% of GDP in 2019, from 5.2% in 2017,” the statement said. Along with the Inland Revenue Act, Sri Lanka will introduce a new Taxpayer Identification Number system. In conjunction with an automation of tax administrative efforts, such initiatives will help to raise tax compliance, broaden the current narrow tax base and improve the composition of the revenue base by raising the share of direct taxes. The government aims to raise the proportion of direct taxes to 40% of total revenue over what the government describes as the medium term from 20% currently.

We expect the cumulative revenue gains from the Inland Revenue Act and other revenue-enhancing measures, along with improved tax administration, to gradually reduce Sri Lanka’s debt burden to about 74% by 2021 from 79.3% of GDP in 2017. Still, government debt will remain well above the median of about 55% of GDP for B-rated sovereigns and will remain high for an economy of Sri Lanka’s size and income level.

A sustainable rebound in real GDP growth will be essential to help support future revenue gains. We expect real GDP to grow about 4.7% in 2018, up from 3.1% in 2017, which was one of the weakest years on record because bad weather hindered agricultural output.”

There is 1 Comment

Typo

Add new comment