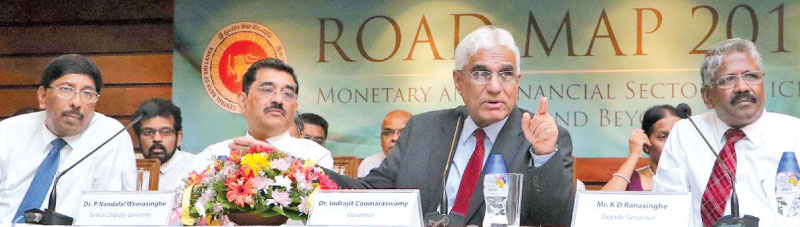

The next two years could see growth picking up to 6-7%, predicted Central Bank (CB) Governor Dr Indrajit Coomaraswamy, addressing a media gathering yesterday, in Colombo.

If the stabilization of the economy continues and the measures put in force in the budget signals that policymaking going forward is going to be more predictable and consistent in the next year or two, there would be a difference.

Apart from the Hambantota Port project, if the plans for Trincomalee and Kandy and highways, megapolis development, etc, gather momentum, one possible scenario is that with greater macroeconomic stability, more consistent and predictable policymaking by the government will result in more domestic investment picking up in the next 12-18 months.

Then the major developments programmes of the government may start having an impact in 12-18 months down the line; so in these two years the economy could see its growth picking up to 6-7% if those things are in place, he said.

On the Golden Key issue, the Central Bank was not for bail out those people, that was a government decision, he said.

The Governor said in 2017 there was a surplus in the primary account and a deficit in the current account. This year he anticipated that there will be a small surplus in both current and primary accounts.

He said ancillary service programmes were not a part of the co-functions of the Central Bank. But the Central Bank has been performing these functions very well.

The flexible inflation targeting regime will be fully implemented by 2020 and they were reviewing all the major Acts such as the Monetary Act, Banking Act, the Finance Business Act.

The Liability Management Act will be tabled in Parliament very soon, he said.

It was not necessarily needed to loosen the monetary policy to achieve the growth which is below the 6% potential and going by 4% now, said Dr Nandalal Weerasinghe Senior Deputy Governor.

There is a gradual easing of interest rates in the market and with that the potential growth is much lower and the Central Bank’s forecast with current policy is a growth of 5.5% and if that is not realized the Central Bank would have to take counter actions in the future.

Similarly there was no necessity to tighten the monetary policy right now, he said.

Dr Weerasinghe said a new series of coins will be released to the market soon in the form of Rs 10, 5, 2 and one.

C J P Siriwardena, Deputy Governor, said there will be Rs 2.5 bn sovereign bond maturities this year and if necessary they will go up to Rs 3 bn to collect the balance Rs 500 million to finance the budget expenditure.

However, he noted that this year there was no international sovereign bond (ISB) maturities but there is about Rs 600 million interest payment for the existing sovereign bonds.

Currently, there are 50 non-banking financial institutions and out of the 50, five are in distress situation and they had different plans for these five distressed institutions which has been submitted to the monetary board and received approval and one has been identified for liquidation, Siriwardena said.

Currently, the minimum capital requirement is Rs 400 million and from Tuesday onwards it has been increased to Rs one billion. A stronger regulatory framework to govern these institutes will be introduced, he said.

Siriwardena said the debt service payment liability in 2018 was Rs 1.9 trillion. Out of this Rs 800 bn will be going for interest payments.

K D Ranasinghe, Deputy Governor, said the large part of EPF investment would be in Government Securities in 2018, which will be about 90%. They will also invest in corporate bonds that will be coming into the market.

Add new comment